Why Commercial Storage Units Are Capturing Investor Attention

Commercial storage units for sale represent a compelling investment opportunity in today’s market. Here’s a quick overview for investors:

- Average asking price: $3.09 million for full facilities in Canada.

- Entry options: Complete facilities ($415,000-$6.2M+) or individual “condo” units (as low as $10,000).

- Revenue streams: Unit rentals, late fees, ancillary services, and specialty storage.

- Investment types: Core (90%+ occupancy), Value-Add (60-90%), or Opportunistic (<60%).

- Key markets: High-growth areas in Canada show 10+ facilities currently available.

The self-storage industry is a thriving sector that offers investors a chance to generate steady passive income. Compared to traditional real estate, storage facilities often require less maintenance while providing multiple revenue streams, from basic unit rentals to specialized services like RV parking and climate-controlled storage.

This market appeals to both seasoned investors and newcomers by combining real estate stability with the cash flow of a service business. Opportunities range from turnkey facilities with high annual cash flow to land zoned for new development, accommodating various investment levels and risk profiles.

With over 30 years of experience in strategy and operations management, I’m Dave Brocious, and I’ve seen how commercial storage units for sale can yield excellent returns. My background in solving complex logistical challenges helps investors grasp both the operational and financial sides of these investments.

Terms related to commercial storage units for sale:

Understanding the Investment: Types of Commercial Storage Units for Sale

When exploring commercial storage units for sale, you’ll find a diverse market. Investments can range from a complete business operation to a single income-generating unit. Let’s break down the options.

Buying an Entire Self-Storage Facility

Purchasing an entire facility means acquiring a ready-made business with existing customers and cash flow. These fall into several categories:

- Turnkey operations are top-tier facilities with 90% or higher occupancy rates. A listed Eastern Ontario facility for $6,200,000 CAD, for example, generates $455,000 CAD in annual cash flow, offering immediate income.

- Value-add properties have 60-90% occupancy, providing room for improvement. A partially developed 14,000 sq. ft. facility priced at $1,960,000 CAD generates $113,000 CAD in cash flow, with potential to increase revenue through strategic upgrades.

- Land for development offers a blank canvas. A 4.527-acre plot in Belleville, Ontario, listed for $2,550,000 CAD, allows you to build a facility custom to market needs from the ground up.

Owning an entire facility gives you full operational control and multiple revenue streams. While the average asking price is around $3.09 million, the returns can be substantial. For more on large properties, see our guide to commercial storage facilities.

Purchasing Individual Storage “Condos”

For smaller investors, buying individual storage units, or storage condos, is an accessible entry point, with some starting as low as $10,000. You own the unit, and a management company handles daily operations. This means lower entry costs and a more passive investment, though you’ll have limited operational control and pay condo fees.

Specialized and Niche Storage Options

The modern storage market includes specialized options that command premium rents:

- Climate-controlled units protect sensitive items like electronics and artwork from temperature and humidity extremes.

- Drive-up units offer ground-level convenience, allowing customers to load and unload directly from their vehicles.

- Outdoor industrial storage provides cost-effective space for large equipment that can withstand the elements.

- RV and boat storage is a lucrative niche, as seen in a Hornet Township, MN facility that sold for $182,000.

- Refrigerated containers serve businesses needing temperature control from -30° to 70° F, such as restaurants or pharmaceutical companies.

- Portable storage units with flat pack and stackable designs offer flexible, mobile storage solutions.

At Sky Point Crane, we understand diverse storage needs. Whether you’re considering indoor industrial storage or need comprehensive commercial storage solutions, the right investment can serve multiple markets and generate strong returns.

The Investor’s Checklist: Key Factors for Due Diligence

Due diligence is your safety net when evaluating commercial storage units for sale. It’s the crucial step that separates a smart investment from an expensive mistake. After 30 years of solving complex logistical challenges, I know that thorough preparation is non-negotiable.

Key areas to examine include location, zoning, market demand, competition, security, unit mix, physical condition, and expansion potential.

Location, Demographics, and Zoning

Location is paramount. A successful facility needs to be easily accessible. Look for proximity to residential areas and highway visibility. A Calhoun, GA facility with 800 feet of road frontage on Highway 53 Spur sat across from a major subdivision, driving steady demand. Population growth indicates future demand, so focus on areas with new housing and business development.

Critically, you must verify zoning laws. A property is useless if local ordinances prohibit storage use or limit expansion. The Calhoun property was zoned C-2 Commercial, and land in Belleville, Ontario, was specifically zoned for storage. Always confirm regulations with local authorities.

Assessing Security and Facility Condition

Customers entrust you with their belongings, so security is essential. Key features include gated access, perimeter fencing, comprehensive lighting, and functional surveillance cameras. On-site management is a significant deterrent to crime and improves customer service.

The physical condition of the property reveals hidden costs. Inspect units for structural integrity, leaks, and pests. Check doors, pavement, landscaping, and office buildings. Deferred maintenance can quickly erase initial savings.

At Sky Point Crane, we know the importance of quality facilities, whether providing business storage for rent or assisting clients with storage needs.

Analyzing the Competition and Market Saturation

Understanding the competition is about strategic planning. Analyze the square feet per capita in the area to gauge market saturation. Low square footage may signal opportunity, while an oversupplied market suggests intense competition.

Check competitors’ rental rates and occupancy levels to understand market health. If most facilities are full, it’s a positive sign. Identify your unique selling proposition—what makes your facility better? This could be climate control, superior security, or specialized storage like the boat and ATV options at the Hornet Township, MN facility.

Investment categories like Core (90%+ occupancy), Value-Add (60-90%), and Opportunistic (<60%) help classify a facility’s market position and potential.

The Financials: Calculating Profitability and ROI

Understanding the numbers is critical when evaluating commercial storage units for sale. A facility’s financial health determines whether it’s a profitable investment or an expensive hobby.

This process involves finding properties, evaluating their income streams, and analyzing expenses to ensure the investment is sound.

How to find commercial storage units for sale and assess their value

Modern tools have simplified property hunting. Online marketplaces like LoopNet allow you to search for specific properties, such as Pennsylvania Self Storage Facilities for Sale – LoopNet, and filter by investment type: Core (90%+ occupancy), Value-Add (60-90%), or Opportunistic (<60%).

Specialized brokers offer insider knowledge and access to off-market properties. For valuation, use comparable sales, assess physical assets, and apply earnings multipliers. Always obtain and verify financial documents like income statements, tax returns, and rent rolls to confirm the seller’s claims.

Understanding Revenue and Operational Costs

Storage facilities benefit from multiple revenue streams. The primary source is monthly unit rentals, but late fees can contribute 5-10% of total revenue. Ancillary income from selling locks, boxes, and moving supplies also adds to the bottom line.

On the expense side, property taxes are a major fixed cost and vary significantly by location. Other key expenses include insurance, utilities, payroll, and marketing. Budget 5-10% of gross revenue for ongoing maintenance and repairs to avoid costly surprises.

Your Net Operating Income (NOI) is your total revenue minus all operating expenses. Dividing the NOI by the purchase price gives you the Capitalization (Cap) Rate, a key metric for comparing investments. Your Return on Investment (ROI) measures your annual cash return against your total initial investment, including your down payment and closing costs.

| Feature | Core Investment | Value-Add Investment |

|---|---|---|

| Occupancy Rate | 90%+ | 60-90% |

| Cash Flow | Stable and immediate | Potential for growth |

| Management | Lower intensity | Higher intensity, requires improvements |

| Risk Profile | Lower | Moderate |

| Investor Profile | Prefers passive income | Enjoys hands-on projects |

A Core property with steady cash flow requires different skills than a Value-Add facility needing major work. Choose the style that matches your experience and available time.

The Acquisition Process: From Offer to Ownership

Once you’ve found the right commercial storage units for sale and verified the financials, it’s time to begin the acquisition process. Breaking it down into manageable steps makes it less daunting.

Financing Your Commercial Storage Unit Purchase

Most investors will need financing, and lenders generally view storage facilities favorably due to their stable income. Common options include:

- SBA loans: The 7(a) and 504 programs often offer favorable terms for first-time buyers, including lower down payments and longer repayment periods.

- Conventional commercial loans: Banks and credit unions are a solid option, typically requiring a 20-25% down payment and a strong business plan.

- Seller financing: The current owner may agree to finance the sale, offering more flexible terms than a traditional lender.

- Syndication: Pooling funds with other investors allows you to buy into larger deals with a smaller personal investment, sometimes as little as $10,000.

Navigating Legal and Regulatory Problems

Navigating the legal aspects is crucial, and it’s wise to hire experts. Key steps include:

- Purchase agreements: Have an attorney review this legally binding contract, which outlines all terms of the deal.

- Title searches: This ensures the property is free of hidden liens or ownership disputes.

- Environmental assessments: A Phase I assessment protects you from liability for pre-existing contamination issues. At Sky Point Crane, our commitment to safety and environment underscores the importance of managing these risks.

- Lien laws: Understand the state and provincial laws governing how to handle delinquent tenants and abandoned property.

- Business licenses and permits: Ensure all necessary licenses are transferred or obtained to avoid closing delays.

As experts advise, always consult with brokers and lawyers before signing any documents. Their upfront cost is an investment against much larger problems later.

Market Trends and the Future of Self-Storage

To succeed with an investment in commercial storage units for sale, understand where the market is heading. The self-storage industry is dynamic, driven by factors like urbanization, smaller living spaces, and e-commerce growth.

Current market trends for commercial storage units for sale

Several key trends are shaping the industry:

- Increased demand: The need for storage continues to grow, driven by population mobility and businesses seeking flexible inventory solutions. This makes storage a resilient asset class.

- Consolidation by REITs: Large Real Estate Investment Trusts are actively acquiring facilities, signaling strong confidence in the sector and often driving up property values.

- Integration of technology: Modern facilities are adopting online rentals, automated payments, and smart units with app-controlled access and individual alarms.

- Focus on customer experience: Top operators are investing in clean facilities, convenient access, and excellent customer service to improve tenant retention.

The Crucial Role of Operations and Management

Even a prime facility can fail without solid management. Operations are what make or break an investment in commercial storage units for sale.

- Professional property management can provide truly passive income by handling marketing, leasing, collections, and maintenance.

- Self-management offers more control and higher profits by eliminating management fees but requires significant time and industry knowledge.

- Facility management software is essential for tracking rentals, payments, and vacancies, streamlining operations for any management style.

- Customer service is a key differentiator. Friendly, helpful staff lead to higher tenant satisfaction and retention.

- Maintenance schedules ensure property longevity and prevent costly emergency repairs.

For large-scale operational needs like facility upgrades, reliable partners for equipment moving solutions are invaluable.

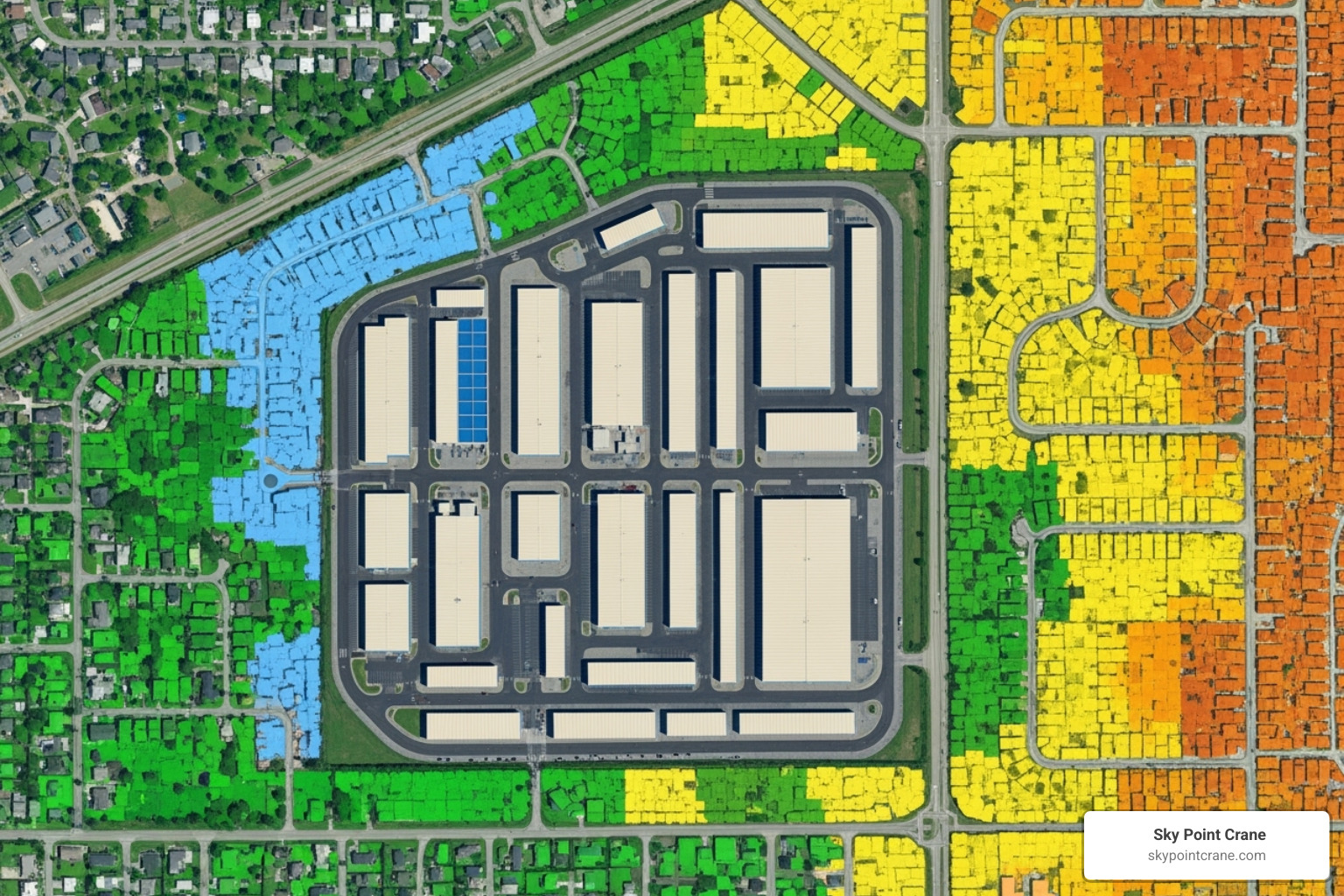

Identifying High-Growth Geographic Markets

While the national market is strong, certain regions offer greater potential. Growing suburban areas are prime targets, as new residential developments create natural demand. Areas with high population mobility, such as regions with strong job markets or military bases, also have consistent storage needs.

The Canadian market offers excellent examples. British Columbia has active listings and has seen over $65 million in recent sales. Ontario has opportunities for both existing facilities and new development. Alberta has also seen significant sales activity, indicating a healthy market across various communities.

In our own service areas—Western and Central Pennsylvania, Ohio, West Virginia, and Maryland—we see consistent demand for commercial and industrial storage, making these regions fertile ground for investment.

Frequently Asked Questions about Investing in Commercial Storage

When investors consider commercial storage units for sale, a few key questions always arise. Here are straightforward answers based on real-world market experience.

What are the biggest risks of investing in self-storage?

While recession-resistant, self-storage is not risk-free. The primary risks include:

- Market oversupply: When too many new facilities are built in one area, it can lead to lower occupancy rates and price wars.

- Economic downturns: Severe recessions can reduce demand as businesses and households cut back on non-essential storage.

- Rising property taxes: As property values increase, tax bills can rise significantly, impacting your net income.

- Aggressive competition: New competitors offering lower rates can pressure you to reduce your own prices, hurting cash flow.

Thorough market research before buying is the best way to mitigate these risks.

How much capital do I need to start?

The entry points for investing in commercial storage units for sale vary widely.

- Syndication deals allow you to own a share of a larger facility for as little as $10,000.

- Individual facility purchases can range from affordable to substantial. A facility in Calhoun, GA, sold for $415,000, while a mini-warehouse in Hornet Township, MN, went for $182,000. On the high end, a turnkey facility in Eastern Ontario was listed for $6.2 million CAD.

- Individual storage condos offer another low-capital path, sometimes requiring just $10,000 to $50,000 per unit.

Start with your available capital and work backward, ensuring you have reserves for unexpected costs.

Is self-storage a truly “passive” investment?

It can be passive, but it is never completely hands-off.

With professional management, your day-to-day involvement is minimal. A management company handles operations, and you focus on oversight. You’ll still need to review financial statements, approve major expenses, and make strategic decisions.

Self-managing is an active role. You are responsible for everything from marketing and leasing to maintenance and collections. This approach maximizes profit and control but requires significant time and effort.

A storage facility is a business that requires active oversight to succeed, whether you manage it yourself or hire a professional team.

Conclusion

Investing in commercial storage units for sale is a compelling opportunity, with facilities selling for a wide range of prices, from $182,000 to over $6 million. The industry’s recession-resistant nature and potential for steady cash flow make it an attractive option for many investors.

As we’ve seen with real-world examples, these are solid investments that can provide reliable income. However, success depends on thorough preparation. The importance of due diligence cannot be overstated—verifying zoning, analyzing the competition, and scrutinizing financial statements are essential steps to protect your investment.

For those looking to build new facilities or expand existing ones, construction and expansion needs can be complex. Having the right partners is crucial for managing the logistics of a major renovation or new build.

At Sky Point Crane, we understand the lifting and moving challenges involved in these large-scale commercial projects. Our 24/7 crane services and NCCCO certified operators support clients across Western and Central Pennsylvania, Ohio, West Virginia, and Maryland. When you’re ready to grow your storage facility investment, explore our industrial storage solutions to see how expert logistics can support your goals safely and efficiently.