Why Crane Rental Insurance is Your Project’s Safety Net

Understanding crane rental insurance is crucial for any construction project involving heavy lifting. It’s your safety net against unexpected costs.

Here’s why it matters:

- Protects your project: Covers damage to the crane or property.

- Covers unexpected events: Deals with accidents, injuries, or unforeseen issues.

- Ensures financial security: Prevents major financial setbacks from incidents.

- Provides peace of mind: Lets you focus on building, not worrying.

At Sky Point Crane, we know that safety is the top priority for any project. Using cranes involves big risks. That’s why having the right insurance is not just a good idea, it’s essential.

We believe in building meaningful relationships with our customers. We focus on solving your problems with unique solutions that truly add value.

I’m Dave Brocious from Sky Point Crane. My 30+ years in strategy and problem-solving have taught me the critical importance of robust crane rental insurance for our customers’ peace of mind and project success.

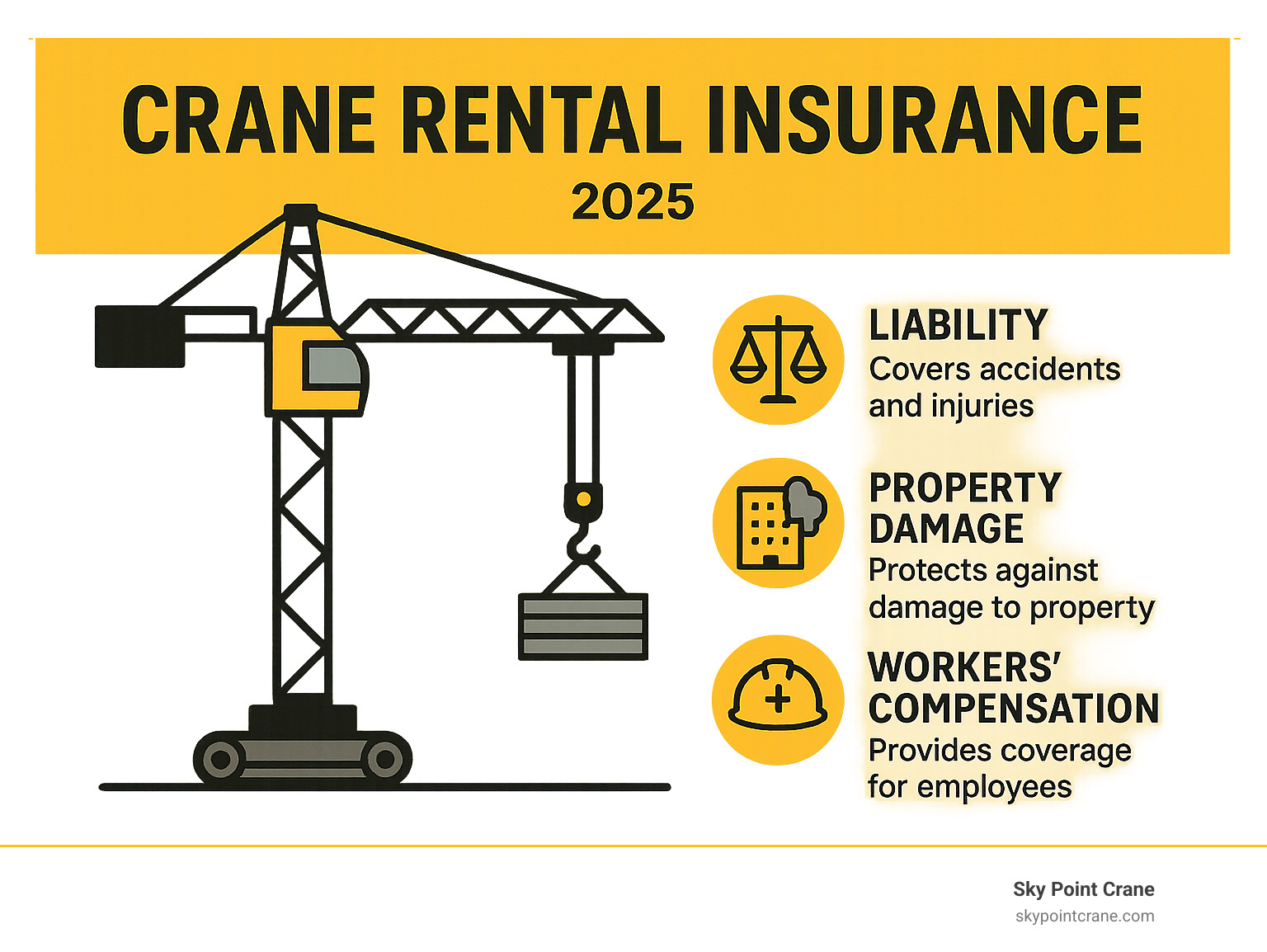

Key crane rental insurance vocabulary:

Understanding Crane Rental Insurance

So, you’re planning a big lift, maybe installing a new HVAC unit on a skyscraper, or setting steel beams for a new bridge in Western Pennsylvania. You’ve got your crew, your plans, and your crane. But have you thought about your crane rental insurance? Think of it as the ultimate “what if” plan for your project.

At its core, crane rental insurance is designed to protect all parties involved in a crane operation from the financial fallout of unforeseen accidents, damage, or injuries. While the overall crane insurance cost can vary, the value it provides in peace of mind and financial security is immeasurable. Without it, a single mishap could derail your entire project, or worse, your entire business.

Liability Insurance: Your Shield Against the Unexpected

One of the most critical components of crane rental insurance is liability insurance. Imagine this: a crane, through no fault of its own (or maybe a little fault, we’re only human!), accidentally damages a neighboring property or, heaven forbid, causes an injury to a third party. Who foots the bill? Without adequate liability coverage, that could be you.

Liability insurance specifically covers damages or injuries to third parties (anyone not directly employed by your company or the crane rental company). This includes property damage, bodily injury, and even legal defense costs if you’re sued. Given the immense power and potential risks associated with cranes, robust liability coverage isn’t just a recommendation; it’s a non-negotiable necessity. It ensures that if an unfortunate incident occurs, you’re not left holding an empty bag, or worse, a mountain of debt.

Operator Insurance Requirements: The Human Element of Safety

While the machinery is impressive, the human element is paramount. Our NCCCO certified operators at Sky Point Crane are highly trained professionals, but even the best can face unforeseen circumstances. This is where operator insurance requirements come into play.

Generally, this refers to the insurance coverage for the crane operator themselves, often falling under general liability for their operations or workers’ compensation for their employer. For us, ensuring our operators are fully covered is part of our commitment to safety and efficiency. It means that if an operator is involved in an incident, their medical costs and lost wages are covered, allowing them to focus on recovery. It’s not just about compliance; it’s about valuing the people who make these complex lifts happen. When you rent a crane from us, you can rest assured that our skilled operators are backed by comprehensive coverage, letting you focus on the lift, not the “what ifs.”

Types of Crane Rental Insurance

Just like there isn’t a “one-size-fits-all” crane for every job, there isn’t a single type of crane rental insurance that covers every scenario. The world of insurance can feel a bit like a complex puzzle, but understanding the key pieces will help you ensure your project is fully protected. Don’t worry, we’re here to help make sense of it all!

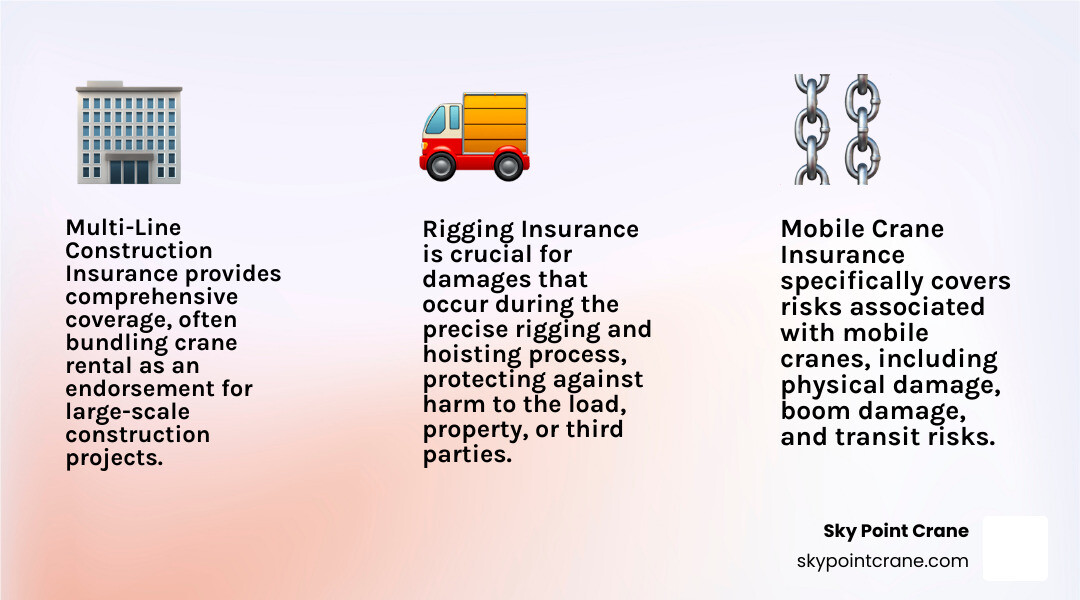

Multi-Line Construction Insurance: The Big Picture

For bigger construction projects, especially those with lots of different contractors, trades, and valuable equipment, a multi-line construction insurance policy often acts as the big umbrella. Think of it as your project’s main safety blanket. This kind of policy usually brings together various coverages, like general liability, property insurance, and even professional liability or builder’s risk.

When you rent a crane, especially for a large project, your specific crane rental insurance might be an added layer or a specialized part of this broader multi-line policy. It’s designed to offer wide-ranging protection, making sure every angle of your complex project is covered, from the very first shovel in the ground to the highest lift. It just makes managing your risks simpler by putting many types of coverage under one roof.

Mobile Crane Insurance: On the Move, On the Hook

Mobile cranes are truly the workhorses of many construction sites. But because they’re always on the move and their operations can be quite dynamic, they come with their own unique set of risks. This is exactly why specialized mobile crane insurance is so important.

This type of coverage specifically deals with the unique situations mobile cranes face. For example, it covers physical damage to the crane itself, whether it’s being driven, set up, or actively lifting. It also includes protection for boom damage, which can be a common and very costly issue unique to crane operations. You’re also covered for transit risks, meaning accidents that happen while the crane is being driven to or from a job site in places like Ohio or Maryland. And finally, it addresses rigging and hoisting liability, covering potential damage to the load being lifted or anything below the lift.

Since mobile cranes are constantly in motion, often navigating tough terrain or busy public roads, having insurance custom-made for their specific way of working is absolutely crucial. It’s not just about protecting the crane; it’s about protecting your investment and everything around it during its journey and operation.

Rigging Insurance: The Art of the Lift

Rigging is truly the unsung hero of crane operations. It’s the precise art and science of getting the load ready, attaching it safely to the crane, and guiding its movement. Here at Sky Point Crane, our comprehensive lifting solutions include expert rigging services. We understand that even with the best planning and execution, sometimes accidents can happen. That’s why rigging insurance is a vital, though often overlooked, part of your protection.

Rigging insurance specifically covers damages that occur during the rigging and hoisting process. This includes damage to the load itself (if the material being lifted is dropped or damaged), damage to property (if the load swings and hits a building, vehicle, or other structure), and even third-party injury (if the rigging fails and causes harm to someone nearby).

Without the right rigging insurance, the cost to replace a damaged piece of equipment or repair a structure could be incredibly high. It’s a critical layer of protection that acknowledges the inherent risks of suspending massive weights high above the ground. When you choose us for your lifting needs, our expertise in crane project management includes carefully planning every aspect of the lift, making sure the appropriate insurance is in place for the entire operation.

Key Considerations for Choosing Insurance

Choosing the right crane rental insurance doesn’t have to feel like you’re trying to solve a puzzle blindfolded. Think of it more like picking the right crane for your job – you need something that fits your specific needs, not just the first option you see.

The truth is, there’s no magic formula for perfect coverage. But there are some key factors that’ll help you make a smart choice that protects both your project and your wallet.

Crane Rental Insurance Cost: Value vs. Price Tag

Let’s talk about the elephant in the room – money. Yes, crane rental insurance cost matters, but here’s the thing: the cheapest policy isn’t always the smartest buy. It’s like buying the cheapest safety harness for a high-rise job – sometimes saving a few bucks upfront can cost you everything later.

Your premium depends on several factors that insurance companies look at closely. The type of crane you’re renting plays a big role. A small mobile crane for a residential job will cost less to insure than a massive tower crane for a downtown project. Makes sense, right?

How long you need the crane also affects your costs. A weekend rental will have lower insurance costs than keeping a crane on site for six months. The complexity of your project matters too. Lifting air conditioning units onto a suburban office building is different from placing steel beams between busy city streets.

Your coverage limits and deductibles create a balancing act. Higher coverage limits mean higher premiums, but they also mean better protection when things go sideways. A higher deductible can lower your monthly costs, but you’ll pay more out of pocket if something happens.

Here’s what we’ve learned after 30+ years in this business: focus on value, not just price. A slightly higher premium for solid coverage that actually protects you beats a bargain policy that leaves you hanging when you need it most.

Insurance Requirements: Meeting the Mandates

Before your crane even arrives on site, you’ll need to steer a maze of insurance requirements. Don’t worry – it’s not as complicated as it sounds once you know what to expect.

Client contracts often spell out minimum coverage amounts you must carry. These aren’t suggestions – they’re deal-breakers. Miss these requirements, and your project could be shut down before it starts.

Government regulations vary by location, and we work across Western Pennsylvania, Ohio, West Virginia, and Maryland, so we see these differences firsthand. Each state, and sometimes individual cities, may have specific insurance mandates for crane operations. Urban areas like Pittsburgh often have stricter requirements than rural locations.

Rental agreements include our own insurance requirements too. We need to protect our valuable equipment, which means you’ll need coverage for physical damage to the crane itself. This is often called “care, custody, and control” coverage, and it’s non-negotiable.

The key is reviewing all your contracts and regulations before you start shopping for insurance. We’re always happy to walk through our requirements with you and help you understand what coverage you’ll need for a smooth operation.

Best Crane Rental Insurance: Custom Protection

Here’s the secret about finding the best crane rental insurance: it’s not about finding the “best” policy in general – it’s about finding the best policy for your specific situation.

Start by taking an honest look at your project risks. What are you lifting? A delicate piece of equipment or heavy steel beams? Are you working in a crowded area or an open field? These factors shape what kind of protection you need.

Don’t just glance at the premium and call it good. Read the coverage details carefully. What’s included? What’s excluded? Sometimes the gaps in coverage are more important than what’s covered. An experienced insurance broker who specializes in construction or heavy equipment can be worth their weight in gold here.

Think about your deductibles and coverage limits realistically. Are you comfortable with the out-of-pocket expense if something goes wrong? Is your coverage limit high enough to handle potential damages? Crane incidents can be expensive – very expensive.

The best crane rental insurance gives you peace of mind. It lets you focus on planning your lift, coordinating with your crew, and getting the job done right, instead of worrying about what could go wrong.

At Sky Point Crane, we believe in building relationships based on trust and transparency. That extends to helping you understand your insurance needs. We want you to feel confident that you’re protected, so you can focus on what you do best – building something amazing.

Frequently Asked Questions about Crane Rental Insurance

We get a lot of questions about crane rental insurance, and for good reason! It’s a complex topic with many moving parts, but understanding it is key to a smooth, safe project. Let’s break down some of the most common inquiries we receive, making it easy to grasp.

What is the cost of crane rental insurance?

Ah, the million-dollar question – or rather, the question that could save you millions! The crane rental insurance cost, or overall crane insurance cost, isn’t a fixed number you can just pick off a shelf. Think of it like asking “how much does a car cost?” It truly depends on what you’re looking for!

Many factors play a part in determining the cost. Things like the type and value of the crane you need (a massive 500-ton all-terrain crane will naturally have a different premium than a smaller 20-ton carry deck). The duration of the rental also matters; a quick one-day lift is less expensive to insure than a crane on site for several months. Then there’s the scope and complexity of your project – a high-risk lift over a busy building or in a tight urban space will have a different premium than a straightforward job in an open field. Even the geographic location can influence rates, as local regulations and population density vary. Finally, the coverage limits and deductibles you choose, along with your company’s claims history, all factor into the final price.

While we can’t give you an exact figure without knowing your specific project details, we can assure you that investing in appropriate crane rental insurance is a tiny fraction of what a major incident could cost you. It’s truly an investment in your project’s security and your peace of mind, not just another expense.

What are the insurance requirements for crane operators?

When it comes to crane operators, our focus is squarely on professionalism and safety. The operator insurance requirements primarily revolve around making sure anyone operating such powerful machinery is qualified, competent, and properly covered. It’s all about protecting everyone involved!

First and foremost, operators must hold valid certifications, like the NCCCO (National Commission for the Certification of Crane Operators). This certification proves their knowledge and skills are top-notch. Here at Sky Point Crane, all our operators are proudly NCCCO certified, showing our unwavering commitment to safety and excellence on every job.

Beyond certifications, there are different layers of insurance. While the crane rental company (that’s us!) typically carries comprehensive liability insurance that covers their operations, sometimes a project might require an independent contractor operator to carry their own liability coverage too. This helps protect against third-party property damage or bodily injury. And for our amazing team members at Sky Point Crane, our workers’ compensation insurance is there to cover any injuries or illnesses they might experience while on the job. This is super important for their well-being and helps keep our operations running smoothly. In some unique, specialized scenarios, professional liability insurance might even come into play for operators or rigging supervisors, covering any financial losses from advice or planning errors.

These requirements ensure that every person involved in the operation is not only skilled but also financially protected. It’s all part of creating a safer and more efficient work environment, minimizing risks from the big machinery down to the skilled hands on the controls.

How does crane rental insurance differ by state?

Just like navigating different state driving laws, crane rental insurance can indeed differ significantly from state to state. While the main ideas of liability and property damage coverage stay the same everywhere, the specific details can vary quite a bit. This is usually due to local regulations, economic factors, and how much risk is generally assessed in that region.

For example, you might find that some states have higher minimum coverage limits for heavy equipment operations than others. What’s perfectly fine for a project in a quieter part of Central Pennsylvania might not cut it for a busy construction site in, say, crane rental insurance Florida or crane rental insurance California. States and even specific towns (like those we serve in Ohio or Maryland) also often have their own unique licensing requirements for crane operators and special permitting processes for setting up cranes on public property. These rules can indirectly affect insurance requirements, as insurers consider how well local laws are being followed. Each state also has its own workers’ compensation laws, which impacts how employee injuries are covered and the associated insurance costs. And finally, states with a history of more lawsuits or specific legal precedents related to construction accidents might see higher insurance premiums.

Here at Sky Point Crane, we operate across Western and Central Pennsylvania, Ohio, West Virginia, and Maryland, so we are very familiar with all these regional differences. We work hard to make sure all our operations and our equipment meet the specific rules of each state. Our comprehensive insurance policies are designed to reflect these diverse requirements, so you don’t have to become a legal expert on state-specific insurance; we’ve got that covered for you!

Conclusion

Whew, we’ve covered a lot of ground, haven’t we? Understanding crane rental insurance might seem like a complex topic, but hopefully, you now see it’s much more than just another checkbox on a project list. It’s truly the strong, silent partner that safeguards your entire operation, protecting you from unexpected bumps in the road and ensuring everyone involved can breathe a little easier. It’s about building a solid foundation of safety and financial security, so you can focus on the big picture.

At Sky Point Crane, we live and breathe this commitment to safety and efficiency every single day. We don’t just rent out cranes; we deliver comprehensive lifting solutions. With over 30 years of expertise under our belts, we’re here for you with 24/7 crane services, top-notch NCCCO certified operators, detailed 3D Lift Planning, and meticulous project management. Our deep understanding of the insurance landscape is just another way we ensure your peace of mind.

When you choose to partner with us, you’re not just getting a piece of heavy machinery. You’re gaining a dedicated team and a trusted ally who shares your goal of a safe, successful project. So, let us put our reliable equipment, expert personnel, and unwavering commitment to work for you. Together, we can lift your project to incredible new heights!