The Unstoppable Surge: Understanding Data Center Expansion

For planning Data center expansion, key considerations include:

- Understanding Demand Drivers: Artificial Intelligence (AI), cloud computing, and digital services are fueling exponential growth.

- Securing Power: Massive electricity needs are a primary bottleneck, driving innovation in renewable and nuclear energy solutions.

- Navigating Regulations: Permitting processes and grid infrastructure upgrades present significant challenges and potential delays.

- Managing Supply Chains: The availability of critical materials and specialized equipment can impact construction timelines and overall costs.

- Evaluating Economic Impact: Projects bring substantial jobs and tax revenue but also require careful community engagement to address local concerns.

The world is seeing an unprecedented surge in Data center expansion, driven by AI, cloud computing, and our digital lives. These powerhouses of modern technology bring huge challenges, needing immense power and water, straining local grids, and requiring trillions in investment. Understanding this fast-changing landscape is crucial.

With over 30 years of experience in large-scale construction projects like Data center expansion, my focus is on delivering value. This guide will help you steer the complexities of this rapidly growing industry.

Data center expansion helpful reading:

The Unprecedented Demand: What’s Fueling the Global Data Center Boom?

Our digital world, from streaming to AI, relies on data centers, and the demand for these digital powerhouses is exploding. The primary driver is Artificial Intelligence (AI), particularly Large Language Models (LLMs), alongside cloud computing and digital services. Every app and online service requires immense processing power.

This demand is not a fad. JLL predicts U.S. Data center expansion demand will grow 23% annually through 2030, while Goldman Sachs Research forecasts a 165% increase in global power needs by then. Generative AI alone is projected to become a trillion-dollar industry by 2032, cementing data centers as the backbone of our modern world. You can learn more in The future of data centers.

The Shift to AI-Specific Infrastructure

The intense needs of AI are changing how data centers are built, moving away from older designs toward specialized infrastructure:

- GPU-based centers: These are becoming standard, designed to house thousands of energy-hungry Graphics Processing Units (GPUs) that are highly efficient for AI tasks.

- Mega-campuses: These massive facilities (1 gigawatt or more) are used for training the most advanced AI models.

- Distributed networks and edge centers: Built closer to users, these centers reduce latency for applications like self-driving cars and factory automation.

- Hyperscale centers: These giants house over 5,000 servers, providing the low-latency processing crucial for everyday AI applications.

These complex facilities are vital, and their development demands precision. If you’re curious about what makes these structures tick, you can explore More info about Mission Critical Facility services.

National Security and the Race for AI Leadership

Data center expansion is also a matter of national security. As geopolitical competition for AI leadership intensifies, data centers are crucial for supporting government, military, and intelligence operations. High-security centers are built for defense logistics and intelligence, holding sensitive data. The location and partners for these centers have significant international implications.

The U.S. government is protecting its AI infrastructure through measures like chip export limits and domestic manufacturing incentives via the CHIPS and Science Act. However, policies that increase costs or create labor shortages can hinder these efforts. Maintaining a lead in the global AI race requires a delicate balance, as detailed in Data centers for national defense strategy.

Global Hotspots: Where is Data Center Expansion Happening?

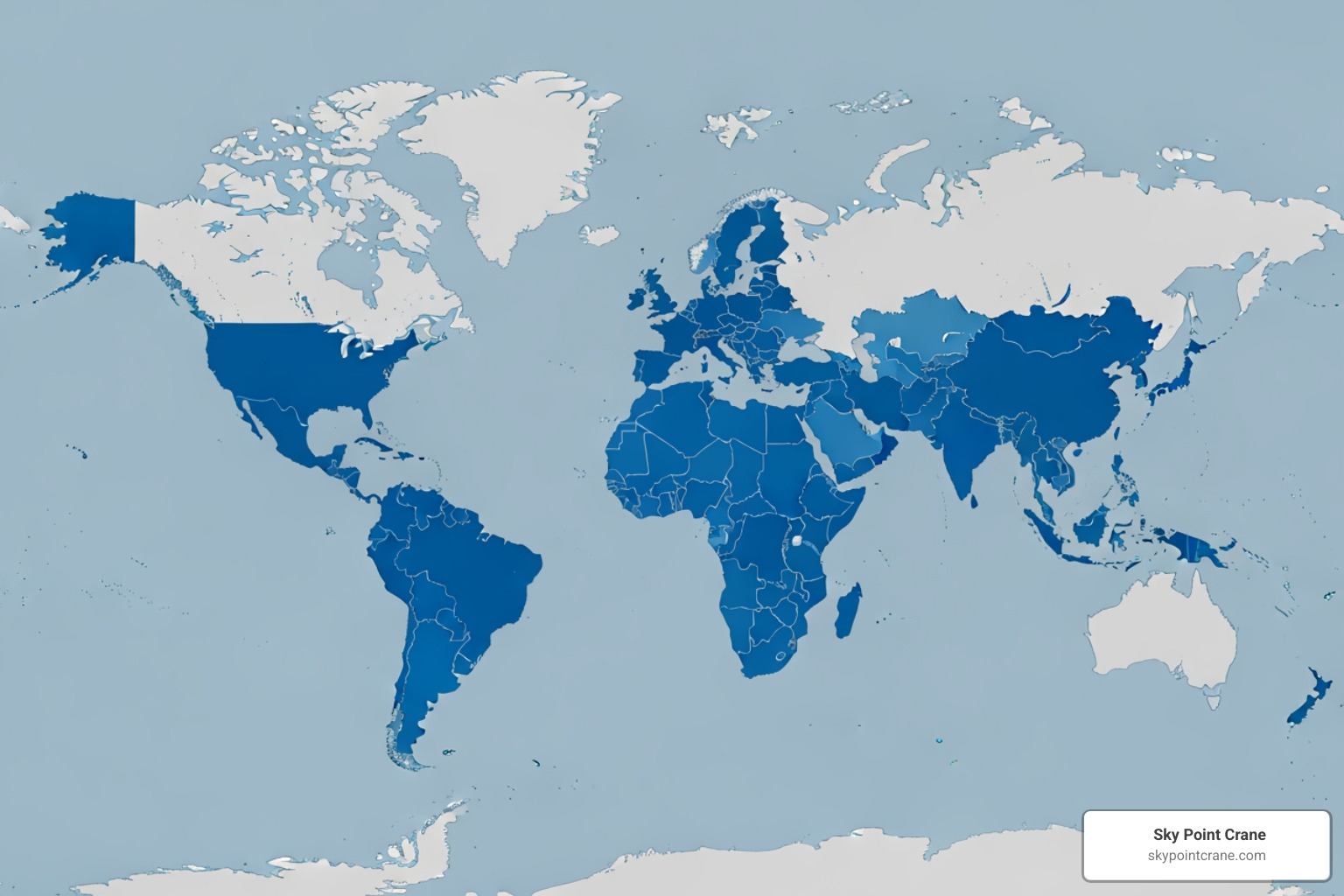

Global investment in data centers is immense, reaching hundreds of billions annually and projected to hit trillions by 2030. While the U.S., China, and Europe are established hubs, Data center expansion is a global race. This section explores key growth hotspots, focusing on North America before looking abroad.

North America’s Powerhouses: Pennsylvania, Ohio, West Virginia, and Maryland

North America leads the Data center expansion race. While “Data Center Alley” in Northern Virginia remains a powerhouse (projected 11,077 MW future capacity), other regions are surging. Phoenix has seen 553% growth, while Dallas-Fort Worth offers affordability. You can explore these trends in JLL’s 2024 report on data centers.

Closer to home, our service areas are becoming key players:

- Pennsylvania: The state is attracting major investment, with a reported $70 billion initiative for AI data centers. A significant development is the planned 2028 reopening of the Three Mile Island plant to power Microsoft’s data centers, promising 3,400 jobs and billions in tax revenue.

- Ohio: The Buckeye State is seeing substantial growth, with Microsoft committing $7.8 billion to its data centers. Cloud provider Expedient also recently expanded its footprint near Columbus.

- West Virginia: Interest is growing in West Virginia, with the state’s potential for data center development being actively explored.

- Maryland: Activity includes the sale of a $29 million Silver Spring data center, with new owners planning expansion.

These regional investments highlight the need for specialized expertise in building these colossal structures. Learn more about our capabilities in More info about Building Data Centers.

Emerging Markets: Latin America, Europe, and APAC

Beyond North America, the race is global. Latin America (Chile, Brazil), Europe (UK, Germany), and Asia-Pacific (India, Japan) are seeing massive investments. For example, Equinix is investing £3.9 billion in the UK, while Tata plans a 1 GW data center in India. The Middle East & Africa are also emerging, with Africa’s power demand growing 20-25% annually. Despite regional challenges like grid and permitting issues, the trend is clear: the world needs more data centers. You can read more about European challenges in Overcoming barriers in Europe’s data centre market.

The Power Problem: Meeting Insatiable Energy and Resource Demands

The biggest hurdle for Data center expansion is power. Data centers are projected to consume up to 12% of all U.S. electricity by 2028, up from 4% in 2023. To illustrate, Northern Virginia’s future capacity will require enough power for 9.1 million homes, forcing the state’s power supply to nearly double in 15 years, as detailed in Virginia’s power supply must nearly double.

This strain on the grid is nationwide, making power availability the primary bottleneck for growth. Water consumption is another major concern, with large facilities using up to 500,000 gallons daily for cooling, impacting local water supplies. This necessitates innovative resource management.

The Rise of Alternative Energy Sources

To meet these energy demands, the industry is investing heavily in alternative energy as a business necessity. Google aims to use 100% carbon-free energy by 2030, investing in solar and wind farms. Other solutions include:

- Battery Energy Storage Systems (BESS): These store renewable energy to stabilize grids and provide backup power.

- Hydropower: A clean, consistent energy source being explored in water-rich regions.

- Energy Efficiency: Companies are deploying advanced cooling, energy-saving servers, and AI-managed power systems to reduce consumption.

These sustainability initiatives are fundamental to the long-term viability of Data center expansion. Storing and managing these power systems requires specialized expertise, which you can learn about in More info about Industrial Storage Solutions.

Is Nuclear the Answer for Data Center Expansion?

Nuclear energy is emerging as a compelling solution, offering constant, reliable, carbon-free power that perfectly matches data center needs. Small Modular Reactors (SMRs), which are smaller and more flexible than traditional plants, are gaining traction for dedicated data center power.

A landmark development is in our region: the planned 2028 reopening of the Three Mile Island plant in Pennsylvania, backed by Microsoft, to power its data centers. This project is expected to create 3,400 jobs and generate billions in tax revenue. This move is part of a larger trend, with projections that U.S. nuclear capacity could triple to 300GW by 2050. The shift to nuclear is a strategic imperative to solve the power problem and ensure the future of Data center expansion.

Overcoming Problems in Your Data Center Expansion Project

Building a data center is a monumental task involving detailed planning, complex logistics, and heavy lifting. Our team understands these challenges because we are on the ground helping turn these visions into reality.

Navigating Construction and Supply Chain Bottlenecks

Even with funding, data center construction faces several problems. Permitting delays from state and local governments for environmental and community impact reviews can slow projects. The supply chain for critical materials like copper, steel, and semiconductors is another bottleneck, with tariffs often increasing costs. A significant labor shortage of skilled electricians and construction workers further complicates timelines. Finally, upgrading grid infrastructure to support new facilities is a long-term effort that adds complexity to Data center expansion. Careful planning and strong project management are essential. We offer comprehensive More info about Construction Project Management and specialized More info about Heavy Lift Crane Planning Solutions to steer these challenges.

Economic Impact and Community Engagement

Data centers have a significant local impact. Economically, a typical project can add $243.5 million to the local economy, create 1,688 construction jobs, and generate $1.1 million in yearly tax revenue. However, community engagement is crucial. While the economic benefits are clear, residents may have concerns about resource demands (power and water), noise, and visual impact. Early and transparent communication with local communities is key for developers to address these concerns and gain a social license to operate.

The Importance of Strategic Lift Planning for Data Center Expansion

Strategic lift planning is critical for Data center expansion. This is where our specialized expertise shines. Building data centers involves moving massive and valuable equipment like generators and cooling units with absolute precision to meet tight schedules.

Modern modular construction methods, which accelerate timelines, require lifting large, pre-fabricated sections into place with perfect coordination. On a high-stakes data center site, safety is our top priority. Our NCCCO certified operators adhere to the strictest safety protocols for every lift.

We use More info about 3D Lift Planning to virtually simulate complex lifts, identifying potential hazards and optimizing crane placement for efficiency and safety. This meticulous planning is central to our commitment to safety, as detailed in our More info about Crane Safety Standards.

Frequently Asked Questions about Data Center Expansion

How much does it cost to build a data center?

Data center expansion is a massive investment. Construction costs average $9.5 million per megawatt in the U.S. Annual operating expenses for large facilities can be $10 million to $25 million. Hyperscale projects, which can exceed a million square feet, often cost over $1 billion to build. The total global investment is expected to reach trillions by 2030, reflecting the complexity of building these 24/7 mission-critical facilities.

What is the biggest challenge in data center expansion today?

Without a doubt, power availability is the critical bottleneck. The electricity demand from AI and cloud computing is outpacing the grid’s ability to deliver. Building new transmission lines can take up to 10 years, which is too slow for the current pace of growth. This challenge is driving investment in alternative solutions like renewables, nuclear power (including SMRs), and on-site power generation. Until the power puzzle is solved, it will remain the primary factor limiting the speed of Data center expansion.

How long does it take to build a data center?

Project timelines have lengthened, now typically ranging from two to six years. Key reasons for this include supply chain constraints for critical components and lengthy permitting processes that can take years. However, strategic approaches can accelerate schedules. Modular construction and efficient heavy lifting operations are crucial for keeping projects on track. Partnering with experienced teams who use tools like 3D Lift Planning helps steer obstacles and minimize costly delays when Building Data Centers.

Conclusion

The world of Data center expansion is explosive, driven by AI and cloud computing. This boom brings immense opportunities but also significant challenges, from securing power to navigating complex construction logistics. As we’ve explored, success hinges on overcoming power bottlenecks, supply chain issues, and permitting delays.

The future will be defined by sustainability and strategic partnerships. However, these ambitious plans require flawless execution on the ground. Building a data center means moving heavy, valuable equipment with absolute precision and safety. Every generator, cooling unit, and modular component must be placed perfectly.

For complex construction projects in Pennsylvania, Ohio, West Virginia, and Maryland, Sky Point Crane is your strategic partner. We bring decades of expertise, NCCCO certified operators, and advanced 3D Lift Planning to ensure your project’s success. We understand the high stakes of mission-critical construction and are committed to getting the job right, one precise lift at a time.

Ready to tackle your next data center project with confidence? Learn more about our comprehensive More info about Crane Services.